Givebutter is turning a profit making tech for nonprofits | TechCrunch

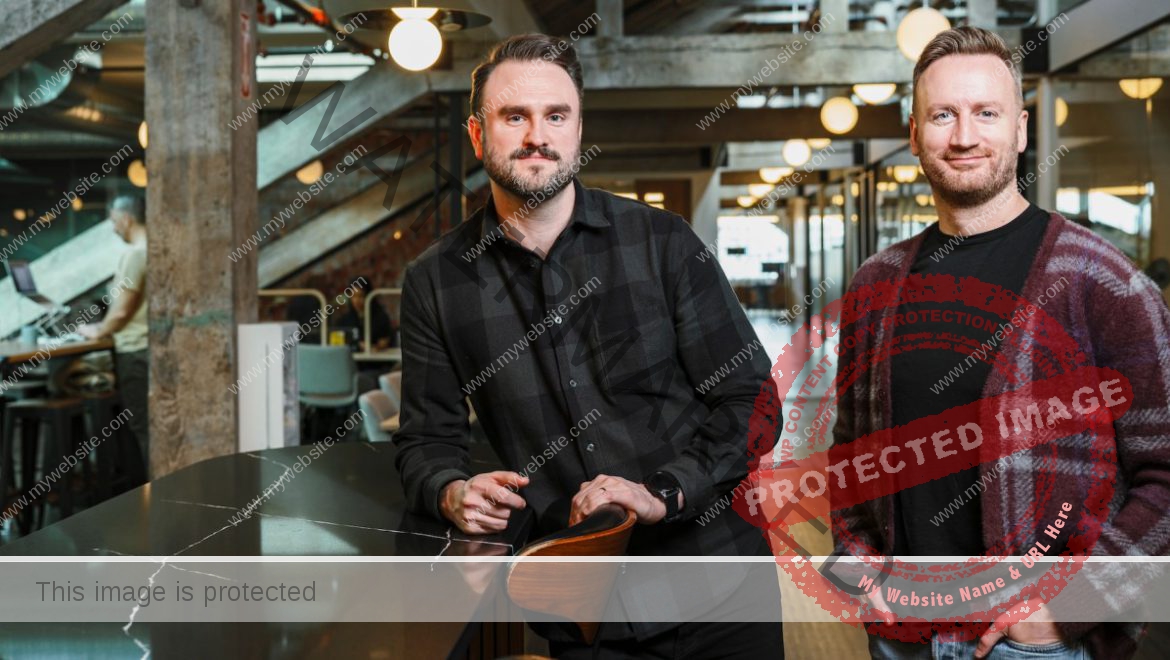

Givebutter started in a George Washington University dorm room in 2016 as a software solution to make nonprofit fundraising more transparent and fun. Eight years later, the company is profitable and it just raised $50 million to scale as momentum for nonprofit-focused startups appears to be growing.

The company’s co-founder and CEO, Max Friedman, fundraised for a variety of organizations in college, ranging from raising for GW’s Greek life to raising for national nonprofits like TAMID. Friedman told TechCrunch that regardless of the size or scope of the organization he was fundraising for, they all had the same problem: They all used a disjointed mix of one-solution tech software that didn’t really make the process better and often came with hidden fees.

“We realized that nonprofits are using a lot of different tools to solve different pain points, and what we can do for the sector is bringing it all under one roof,” Friedman said. “It exists in restaurants and in e-commerce; there [was] no Shopify or Toast for nonprofits.”

The result was Givebutter, a CRM platform for nonprofits that strives to be transparent and all-encompassing. It features marketing resources, ways to track donors, fundraising tools for a variety of different strategies, and payment processing. Nonprofits can either use Givebutter for free, if their fundraising campaigns offer a place for users to donate to Givebutter, or organizations pay a 1% to 5% platform fee.

“From day one, we had customers,” Friedman said. “It was very clear that there was a lot of demand for great fundraising tools and not a great tool set for those change makers.”

The startup raised $50 million from Bessemer’s Venture Partner’s BVP Forge Fund with participation from Ardent Venture Partners this week. Friedman said the money will be used for marketing to help the startup scale as the company has grown to this size thus far largely with almost zero marketing spend.

What initially got me interested in this deal — beyond the fact that the company is profitable from a largely donation-based revenue system or the fact that it calls its employees “Butter Slices” — was that it was a sizable round in the nonprofit tech sector, which has been popping up significantly more as of late.

During the most recent YC Demo Day, two startups, Givefront and Aidy, were building tech for nonprofits. While these companies weren’t the first nonprofit-flavored startups to ever go through YC, they are some of the first to be building software for the nonprofits; many past YC companies in the space are nonprofits themselves, and Givefront and Aidy absolutely stood out in this year’s AI- and dev-tool-dominated cohort.

I asked Friedman if it felt like momentum in this category had changed since he got started eight years ago, and Friedman said it definitely has and that the timing is right for this category. There has been a lot of recent consolidation in the space, especially regarding private equity-backed nonprofit software players like Bloomerang and Bonterra, each of which has made a handful of acquisitions in the last few years alone. This leads to higher fees and many nonprofits looking for less-expensive solutions, Friedman said. Once people get interested in the sector, he said, they often realize how big the potential market is.

In 2022, Americans donated nearly $500 billion to charity, according to the National Philanthropic Trust, down 3.4% from 2021. There are more than 1.5 million nonprofits and growing, and building to even get a slice of that market could provide a huge windfall. Givebutter is a good example of this. The company works with more than 35,000 nonprofits and has processed more than $1 billion in donations, but it is still barely making a dent in the overall nonprofit industry.

“We have about 1% market share,” Friedman said. “That’s amazing. I’m really proud of that, but I’m also like there are 99% of nonprofits out there that can benefit, and a big part of why we raised was to go do that.”

Givebutter might just start to run into more competition on the way. “Nonprofits are incredibly resilient,” Friedman said. “There [have] been downturns and upturns in the economy for a number of years and nonprofits have grown. Nonprofits also solve some of the world’s largest problems. I’m happy to see more people being aware of that and investing in that.”