Amazon has quietly introduced a “special store” called Bazaar in India, featuring affordable and trendy fashion and lifestyle products, as it ramps up efforts against Walmart-owned Flipkart and Reliance’s Ajio, which have made deeper inroads in the Indian fast-fashion market.

The world’s largest e-commerce firm has rolled out the new store on its India Android app. Amazon began recruiting sellers for the new store in February, TechCrunch previously reported, promising them “hassle-free” delivery, zero referral fees, and access to a vast customer base.

“You can find items from clothing, accessories, and jewelry to handbags, shoes, traditional and western wear, and a wide array of home goods including kitchenware, towels, bed linens, and décor items,” the company wrote on a support page.

The growing popularity of affordable fast-fashion is increasingly driving purchases on many Indian shopping apps, making it crucial for Amazon to have a strong play in a category where it has traditionally struggled in the country, according to brokerage firm Bernstein.

“India e-commerce category mix is changing; Mobiles and Consumer electronics share is declining. Fashion has seen the strongest growth since FY19, and now holds the highest category share,” Bernstein analysts wrote in a note last month.

Bazaar’s offerings include “trendy” T-shirts starting at 129 Indian rupees ($1.55) and sneakers priced under $3.

India is a key overseas market for Amazon, which has invested more than $11 billion in the country to date. Despite the company’s cloud unit, AWS, maintaining its market-leading position in India, Amazon’s e-commerce arm holds the second spot behind Flipkart.

Last year, chief executive Andy Jassy announced plans to invest $12.7 billion in AWS in India by 2030, while also committing over $2 billion to the e-commerce division during the same period.

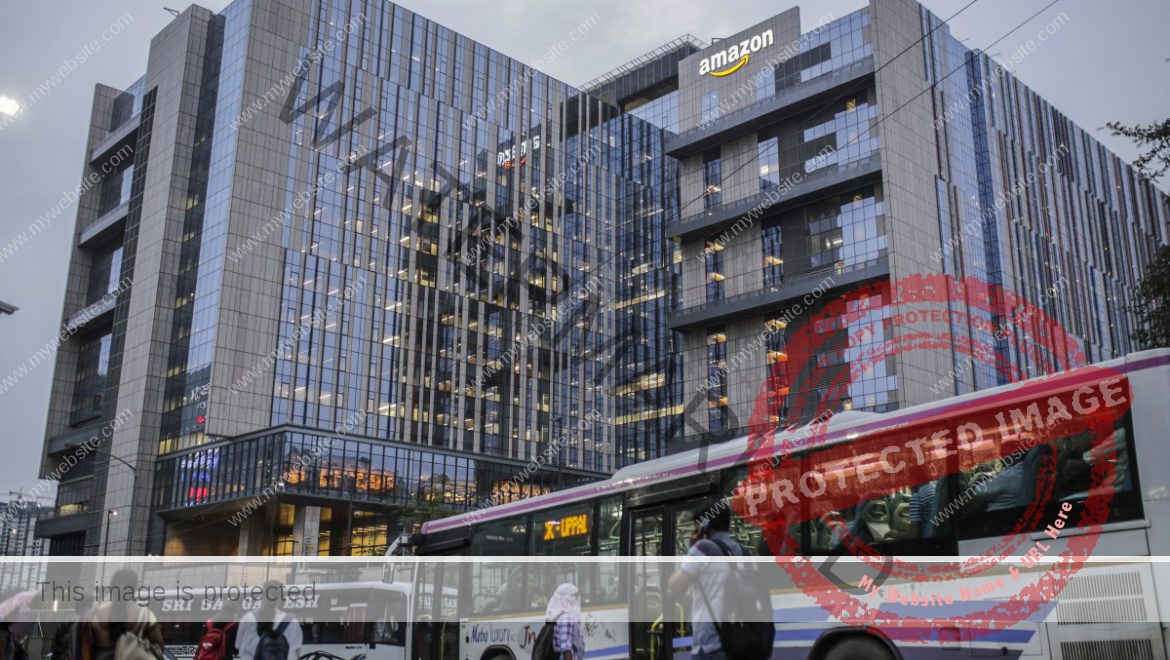

Screenshot of Amazon India Android app. Image Credits: TechCrunch

The fast-fashion e-commerce market has gained significant traction in India in recent years, with local startups drawing inspiration from global pioneers like Zara, H&M, and Uniqlo. While Flipkart (which owns fashion e-commerce platform Myntra) currently leads the category, it faces increasing competition from Reliance’s Ajio, which has captured approximately 30% market share in about a year, according to Bernstein.

Ajio launched its own fast-fashion platform, Ajio Street, last year, offering a wide selection of clothing and accessories at prices as low as 199 Indian rupees ($2.4). The platform guarantees the “lowest price” for its products, waives delivery charges, and offers a straightforward returns process.

Shein, a global pioneer in the category that was earlier banned by India, said last year it was prepping a return to the country through a joint venture with Reliance, the nation’s most valuable company. The oil-to-telecom giant also operates Reliance Retail, which is the nation’s largest retail chain.