Nearly 20 years after finding success in helping startups build products, Canadian interface design firm Metalab has launched Metalab Ventures to invest in many of those product-led startups.

Serial entrepreneur and investor Andrew Wilkinson started Metalab in 2006, a company that went on to support product innovations by companies including Slack, Coinbase, Uber and Tumblr.

Metalab often works with startups, acting a bit like co-founders, to help them get a product off the ground. Then Metalab “lets them loose” to grow, CEO Luke Des Cotes told TechCrunch. Metalab had a record year in 2023 and was involved in the development of 40 products that went into the market last year.

Corporate venture capital has found its stride over the last decade as a stable source of capital or when startups have something Big Tech wants.

With Metalab Ventures, the venture arm will play the role of a long-term value investor, essentially “putting our money where our mouth is,” Des Cotes said.

“We want to go on a journey with them for the next 10 to 12 years,” he said. “We’ve been asked over and over again by founders when we will invest, and sometimes we have, but it’s been very ad hoc in the past. Today, we make that a formal process.”

Metalab Ventures has raised $15 million in capital commitments for its first fund to invest in product-led startups where strategy, design and technology are the key differentiators.

“Product-led” is how a product will be the differentiator for the business, Des Cotes said. Most businesses have some major component of success riding on how well a product is created and how well it’s connecting to the user. Metalab Ventures seeks out founders who “believe in the power of design as a tool to be able to connect with users in a way that’s different and special,” he said.

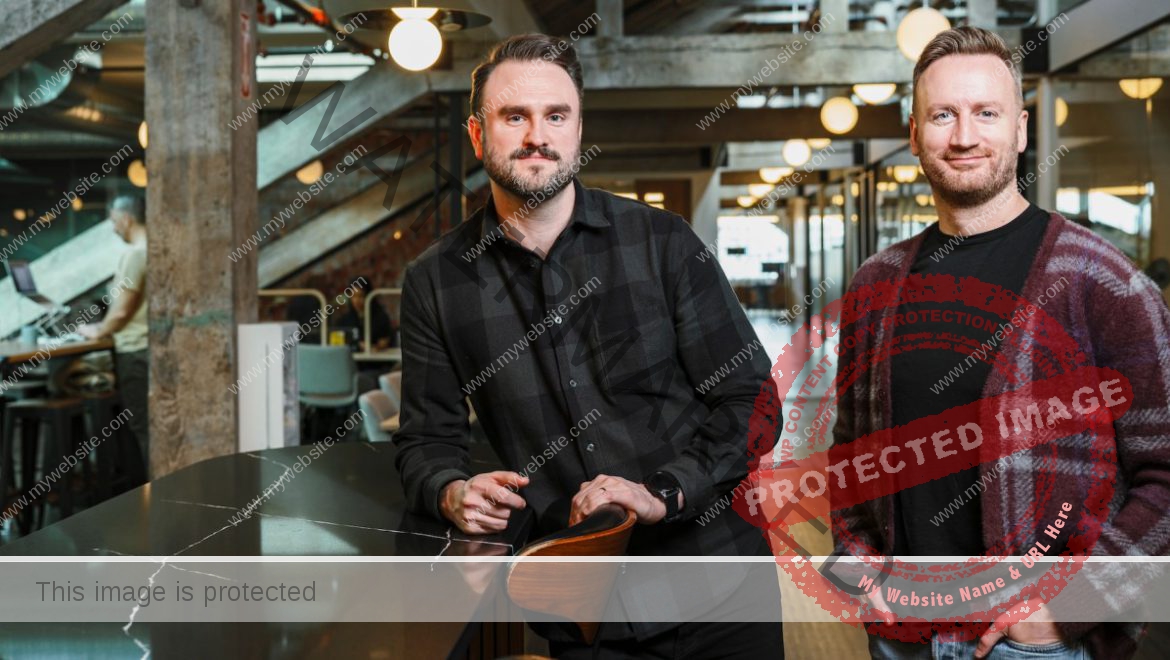

Des Cotes and David Tapp, head of partnerships at Metalab, are the general partners at Metalab Ventures and will invest in 25 to 35 startups at the pre-seed, seed and Series A stages. So far, the firm made a handful of unannounced investments, Des Cotes said.

The limited partnership makeup of the new fund includes institutional, funds to fund, angel investors and founders of companies with whom Metalab has previously worked. Metalab is also an LP in the fund.

The company performs diligence on thousands of founders each year to determine who it will help, and that same process was shifted to Metalab Ventures in the way it evaluates investments, Des Cotes said.

When determining who to invest in, the process includes getting to know the founders and if the firm can add value. Metalab often taps into its 160-person workforce for design, technology, product and research leadership.

“We’ve already operated very much like a venture fund,” Des Cotes said. “Now we are working through that process to understand what’s the product, what’s the opportunity, what’s the value that can be created here. When we believe in this business, we think of human capital as being our scarce resource that we can then deploy into those businesses.”

Have a juicy tip or lead about happenings in the venture world? Send tips to Christine Hall at [email protected] or via this Signal link. Anonymity requests will be respected.